What Fintech Is And Why All Businesses Should Care

Graham is the Co-Founder and Managing Director of Buzinga.

When you think ‘tech startups’ or ‘massive disruption’ the financial sector isn’t what first springs to mind.

And yet, it makes complete sense that a stagnating industry so integral to our society’s functioning would be ripe for innovation.

In this article I’ll cover what fintech means for businesses, why you should care, and how fintech startups are overhauling the antiquated financial services industry.

What is ‘fintech’ and how did it come about?

Fintech, or financial technology, is a fresh term describing technology startups working in financial sectors like mobile payments, money transfers, loans, asset management and fundraising (to name just a few!).

While the breadth of fintech firms is hugely diverse, they all serve the common purpose of making financial systems and markets more efficient.

Traditional finance models and corporations aren’t as necessary as they once were, and it’s completely changing the game for businesses.

A business owner no longer needs to go to their local bank to get a loan, or knock on the doors of traditional investment firms to get seed funding, or write a check to transfer money, for example.

Crowdfunding, mobile payments, and collaborative consumption models are evolving the incumbent market systems, making them cheaper and more open to the everyday finance consumer.

These fintech firms are agile and have the ability to pivot much more readily than the slow-moving giants.

And who’s to thank for their existence? The digital revolution, of course.

As Jens Munch so aptly put it: “Technology allows David to compete with Goliath on a far more even footing.”

Open source platforms and cloud computing has made it much easier for independent startups to break into the finance industry, which not long ago had impossible barriers to entry.

Why should businesses care?

Source: Raconteur

It’s never been easier to start a business, or expand one. The bureaucratic costs and communication inefficiencies that are synonymous with large corporations are slashed by fintech firms.

What this means is that businesses can offer more services than ever, and at a fraction of the cost.

Keeping up to date on innovations in this area is vital to making sure you remain a market leader.

Many older financial institutions are waking up and doing just this. The global financial crisis made it clear that banks needed to innovate, but the question was how they could harness the opportunity provided by fintech without the resources to do so.

That’s why the demand for fintech startups is largely being driven by banks, capital markets firms and insurers, who are striving to remain competitive in the long term by investing, incubating or partnering with fintech groups.

A widely cited report by Accenture indicates that global investment in fintech ventures has tripled from around $1 billion in 2008 to nearly $3 billion in 2013, and is projected to reach up to $8 billion by 2018.

What’s most exciting about fintech is how it affects everyone in the business world, from multinational corporations to small businesses to individual consumers, even the ‘unbanked’.

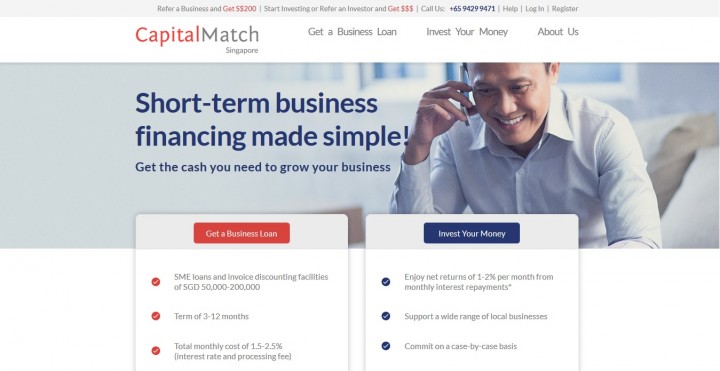

Capital Match is a Singapore-based startup using a collaborative consumption model to connect SMEs to investors.

Source: Fintchranking

The peer-to-peer technology gives underbanked business owners access to a pool of private savings from investors who are promised a premium on their savings.

This gives SMEs an alternative to getting a small loan from a bank with up to 10% interest rate, or using unregulated lenders. Typically SMEs have a very high loan rejection rate, which prohibits them from scaling their business.

According to CEO Kuznicki, giving SMEs access to capital means they can grow their business up to a point where banks are happy to serve them, and start taking full advantage of the financial system which they previously had limited access to.

Fintech startups may just be gaining momentum now, but we know from companies like Airbnb and Uber that collaborative alternatives have the potential to hit the mainstream very quickly.

If you are a small business owner or a startup founder, knowing about the fintech solutions available to you could save you time and money in the quest to scale your business.

And if you’re a finance corporation, partnering them is vital to customer retention and long term sustainability.

What falls under the FinTech umbrella?

Fintech firms encompass a range of sub-industries within the finance sector.

Here are some of the areas we’re already seeing transformations in the way of:

- Mobile payments

- business and personal lending

- investments

- asset management

- fundraising

- digital currencies

- data collection

- cyber security

- quantum computing

How is it changing the financial industry?

Now that you know what it is and why you should be excited, let’s have a look at some of the ways fintech is changing the way we do business.

1. Getting rid of intermediaries

At a high level, the purpose of most fintech firms is to eliminate the middle man.

Since the global financial crisis, we’re seeing a change in consumer attitudes toward traditional financial institutions, to ones of frustration and distrust.

According to an annual survey by Edelman, the financial services industry is the world’s least trusted industry. 43% of Americans who are saving money don’t plan to do so in a bank account.

This perceived lack of transparency from financial corporations, whether warranted or not, has led to the creation of platforms which ‘disintermediate’ transactions.

Only 20 years ago, the local bank was a one-stop shop for all personal finance activities.

Today, we transfer our money using PayPal, file our taxes with Turbo Tax, manage funds with Wealth Front, apply for a student loan through SoFi, get financial planning advice from LearnVest…The list goes on.

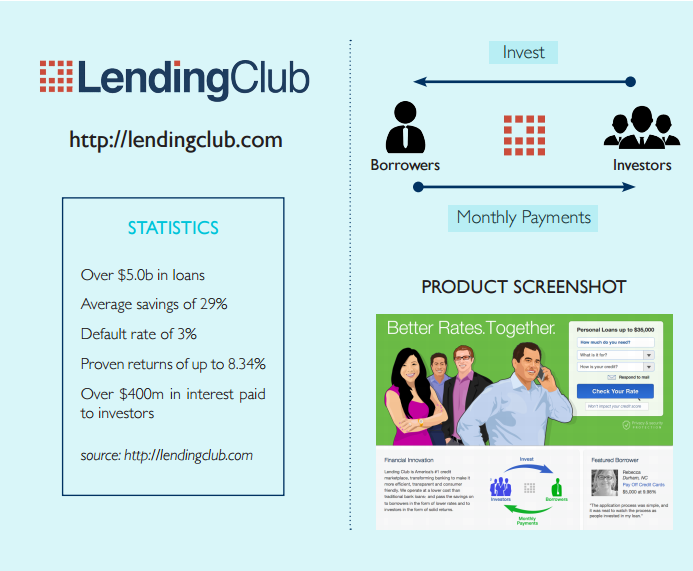

Peer-to-peer lending

Small businesses that lack a finance department or finance experience aren’t attractive to lenders.

Lending Club is the flagship company leading the lending revolution, having distributed over $5 billion in loans since its launch in 2006.

Source: Adventure Capital

Loans start at $5000 and can go up to $250,000 depending on the borrower’s credit, though the average is $15,000.

The lender and the borrower interact directly through a simple online channel, often with much lower interest rates.

These platforms typically use machine-learning algorithms to quickly analyse credit history, self-reported data, and behavioural data to judge the ability of a loan applicant to repay.

This loan-approval process is much faster than going to a bank for a business loan.

Nimble, a web app competing directly with Cash Converters, gets small cash loans of $100-$1600 to your bank account within 60 minutes of approval.

Crowdsourcing

Source: Forbes

Another buzzword for the lean startup is crowdsourcing.

It provides a viable alternative to the months of investor pitching and fundraising that goes with getting a business funded.

With the right strategy to accompany a crowdfunding campaign, a startup can pitch to the world and get funded in weeks, rather than months.

Platforms like KickStarter and Go Fund Me have raised a combined $2.75 billion for campaigns as diverse as robotics, home renovations and holidays.

The only requirement to succeed is a great idea.

Kickstarter takes an “all or nothing” approach to funding. If people like the idea they can pledge money to help it reach its goal, but if the project doesn’t reach its goals the backers’ credit cards won’t be charged.

‘Investors’ are then rewarded with early product release or discounts, and some sense of ownership over a startup.

Once a project is successfully funded, Kickstarter takes a 5% fee of the funds collected.

But what about investors who want more than a ‘thankyou note’?

Cadia Startup Exchange is the world’s first equity crowdfunding platform with a 24/7 secondary market for startup entrepreneurs, SMEs and unaccredited investors.

Cadia offers investors actual company shares in the projects they fund.

As an investor, you can buy and sell shares anytime, get voting rights and dividend payouts. As a startup or SME, there is no fee to sign up and your business gets automatically listed on the secondary market.

The service is flexible and takes care of everything for you – You can list an existing company, sell part of it or get more funds, or just use the platform to manage relationships with investors.

Check out the video below for more information.

The success of the crowdfunding business model is down to recognising that peer trust is stronger and more abundant than institutional trust.

Typically, initial funding comes from friends and family, though word of mouth spreads quickly through press, blogs, social media and the platform itself as a major source of funding.

2. Making sense of data

Source: Eduvantis

Bringing the financial services industry into the technological age has brought with it a lot of data, and with data comes greater expectations to deliver benefits to the consumer experience.

Financial firms are now facing the problem of having an overwhelming amount of data in their systems, and no cost-effective way to mine it for valuable customer insights.

Enter: Fintech companies like Billfloat and Zestcash that exist to make data collection and interpretation simpler, as well as protecting this data with secure cloud computing systems.

With recent high-profile data hacks to companies like Sony and Kmart, it’s no surprise that online security is a high priority for customers.

82% of consumers reported that they would buy more online from small businesses if they showed they were protected from cyber crime. This is a huge sales opportunity!

While many big banks are partnering with these IT startups to make sense of their data, the reality is that their fintech startup competitors have the edge when it comes to actually putting it to use.

The fat cats don’t have the flexibility to pivot and jump on trends signaled in big data like small startups do.

What could the benefits derived from this data look like?

This data can help companies collect information on consumer demand and behaviour, leading to personalised spending recommendations and credit ratings.

As well as collecting data from online financial systems, we can also expect data from other sources (such as social networks) to feed into these financial services as another source of customer information.

Facebook, Pinterest and Instagram have been experimenting for a while now with ways to bridge the gap between lifestyle and entertainment.

One of these experiments involves displaying a ‘buy’ button on promoted products, which would allow people to purchase straight through the social network without being redirected to the brand’s website.

3. Improving the customer experience

Source: Customerforlife

Fintech that integrates with existing business solutions are adding enormous value to the purchasing experience for consumers.

Innovations in internet banking and payments are mostly coming through mobile, and revolutionizing the way businesses interact with customers.

Mobile banking has never been safer, and public perceptions are finally catching up to this fact.

Mobile is now the fastest-growing platform for banking transactions for individual consumers and businesses alike.

It’s all building up to the day when our phones become ATMs!

Apple Pay is the new frontrunner for contactless payment in-store, while ‘cryptocurrencies’ like Bitcoin are finally gaining ground with major retailers (although it’s expected that mainstream adoption will take several years).

The rise of social media is also adding to the perceived transparency between these businesses and their customers, making them seem more human and customer-first.

Payment app Venmo even integrated its own social platform within the app, encouraging users to share a description of what each transaction was for.

Predictably, there are some hilarious exaggerations and fabrications of these transactions (check out these examples from Mashable). It’s all part of the user experience.

Meanwhile, multinational corporations are responding to the pressure from customers to innovate.

Westpac New Zealand recently partnered with New York-based Moven to deliver consumers a new range of mobile initiatives, and should be available later this year.

Moven is a real-time purchase and budget tracker which will be integrated with Westpac’s internet banking app. It also offers tools to help users decide if they can afford to make a purchase.

Never one to be left behind, Starbucks partnered with Square, one of the hottest Silicon Valley fintech startups, to offer an additional payment service for its app users.

Source: Android Authority

It’s these kind of offerings that are particularly valuable to consumers, with 1 in 3 customers reporting they wanted retailers to make mobile more integrated into the shopping experience.

4. Improving financial literacy for businesses and consumers

Perhaps the most exciting side-effect of fintech innovations is its potential for social impact.

Lessening the gap between the rich and poor, the urban and isolated, is something that fintech does without even meaning to, through wider access to payment and financial resources.

There are lots of exciting educational tools in the app development space, covering everything from personal finance to stock trading and accounting.

Simply Wall Street is an Aussie startup aimed at beginner investors, “making investing in the stock market as easy as buying groceries”.

Available as both a web and mobile app, this is a much more user-friendly way to access financial data than going to Bloomberg or Yahoo Finance.

It takes real-time data on companies and exchanges and turns them into rich images like infographics. Additional features include personalised stock suggestions and ongoing portfolio management.

Source: Betalist

Traditional wealth management firms are being urged to adopt more collaborative models, as they may have a hard time charging 1% or 2% of assets when self-directed investors can get these client advisory services for free.

In the accounting sphere, Xero is a cloud-based accounting software provider totally revolutionizing the way small businesses approach accounting. It’s user friendly and aimed at the non-accountant.

What these resources do is prioritise the user experience with a simple interface and non-technical language, breaking down barriers for business owners without a finance degree.

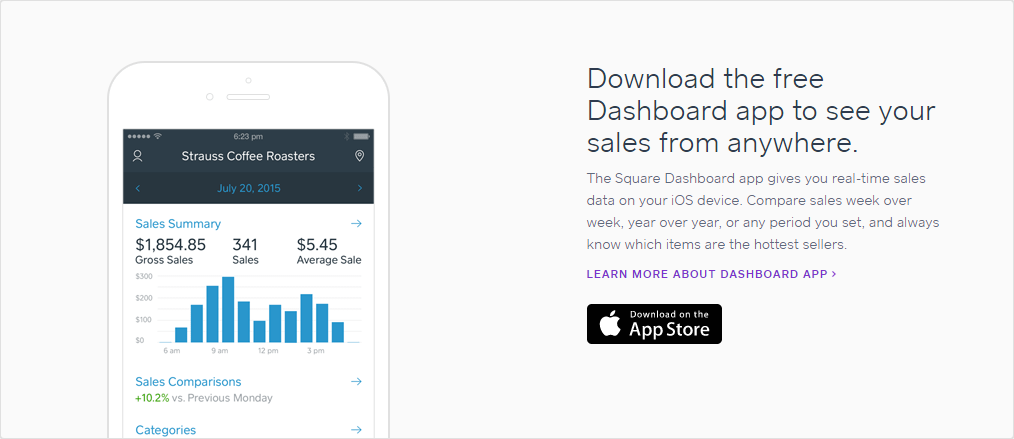

Check out the beautiful interface of Square, an all-in-one financial services, merchant services aggregator and mobile payments software for businesses.

Its tagline is “making commerce easy”, and is certainly does just that with its real-time graphs available on mobile and online.

Source: Square

You can see that the real impact of fintech is measured by how it empowers every individual to have access (and control) over their own investments, savings and expenses.

With demand booming, there’s never been a better time for startups to disrupt the financial industry.

Fintech startups have the potential to completely overhaul incumbent market systems, and it’s no wonder small businesses and large corporations alike are taking interest.

It will be interesting to see which financial institutions are first to go, and which will stand the test of time through delivering a more transparent and efficient way of doing business.

Graham McCorkill

Latest posts by Graham McCorkill (see all)

- Why digital security should be part of every business strategy - April 18, 2017

- How to use Mobile to Disrupt Your Recruitment Game - January 27, 2017

- The 3 Step Loop For Delivering Apps On Time And On Budget - November 11, 2016

Pingback: Google()